|

NRI Investing- Common

Queries answered

Main

Article page |

Beauty articles

|

Health page |

Computers|

Diseases |

Education |

Family

Fitness|

Fruits and Vegetables

|

Jobs |

General |

Personality|

Technology |

Tourism

Financial Planning

for Non Resident Indians can be much the same as Financial Planning for Resident

Indians – there are only a few things which NRIs need to keep in mind when

executing the Financial Plan i.e. when investing.

In this article we

will cover India as an investment destination, how to figure out if you are an

NRI, things to keep in mind when investing in India as an NRI, NRI taxation and

which are the different bank accounts to invest from.

First, let’s

consider how to know whether you classify as an NRI or not.

The classification

is actually very simple.

The Income Tax Act

classifies residential status of a person into ‘Resident’ and ‘Non-Resident’

(NR). It further classifies ‘Resident’ into ‘Ordinarily Resident’ (ROR) and ‘Not

Ordinarily Resident’ (RNOR), which is applicable only to Individuals.

An individual is

'Resident in India' if he/she fulfils any one of the condition

(basic conditions) given below with reference to his/her stay in

India during the previous year (i.e. April to March).

- If he/she is in India in that year for a

period or periods amounting in all to 182 days or more or

- If he/she is in India in that year for a

period or periods amounting in all to

60 days or more and if

he/she has within the 4 years preceding that year been in India for a period

or periods amounting in all to 365 days or more.

There are a couple

of exceptions to the above stated conditions.

Exceptions:

The period of 60

days in (2) above is to be read as 182 days in case of a Citizen of India:

- who leaves India in any previous year as a

member of the crew of an Indian ship or

- for the purpose of employment outside India

or

- a Citizen of India, or a person of Indian

origin, who being outside India, comes on a visit to India in any previous

year.

Thus, to be resident

in India, a person has to satisfy any one of the above two basic conditions. If

a person does not satisfy any of the above conditions he/she is determined as

‘Non Resident’ in India.

Once a person is

determined to be resident in India, he may further be ‘ordinarily’ or ‘not

ordinarily resident’ in India.

To determine whether

a person is ‘Ordinarily Resident’ he/she has to satisfy any one of the condition

in the relevant previous year:-

- he/she has been ‘resident in India’ in 2

out of 10 years preceding that year, or

- he/she has been in India for a period or

periods amounting in all to 730 days or more during 7 years preceding that

year.

Now that we

know how to classify oneself, lets move forward to assess India as an Investment

Destination – compared to the other emerging nations.

The recent down

economic down-turn has made a number of Indians working in a foreign country

become concerned about their job security and investment options. This has made

them think about managing their finances in a better way by taking professional

advice and by investing more money in India – their home country. The India

Shining story is something we have all heard, but is it really true when

compared to other developing nations such as Brazil, China and Russia?

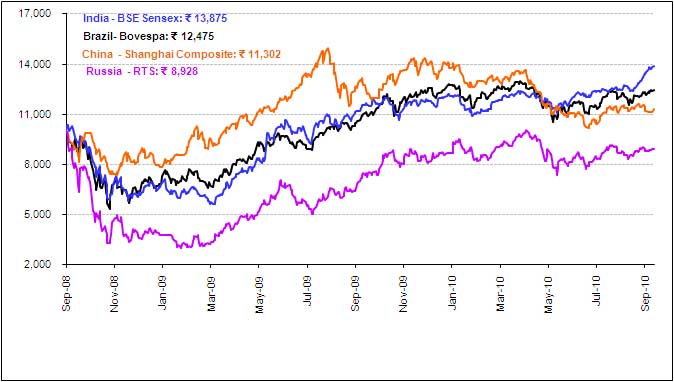

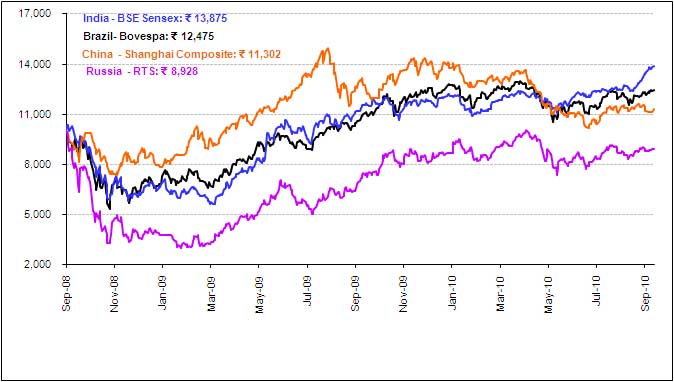

As is shown in the

chart above depicting India, Brazil, Russia and China post the downturn of 2008,

India has slowly and steadily outperformed the rest of the emerging nations,

proving that as an investment destination, we need to look no further than our

own home country to help us plan for and achieve our life’s financial goals.

However, deciding

which country to invest in is only the beginning. It is important to also know

where to invest your money, which account to invest from, how much to invest and

the tax applicable to your investments. Each of these is dealt with ahead.

Let us

proceed on to Where to Invest.

The investment avenues for NRIs are broadly the

same as investment avenues for Resident Indians, with a few small points to keep

in mind:

Direct Equity: NRI’s

can invest their funds in equity markets. But, before investing in equity one

should take into account the time horizon of investment, risk and return

expected on the investment and the long term goals. There is no limit or cap for

NRI’s investing in direct equity.

Mutual Funds: A

Mutual Fund would be a safer bet compared to direct equity for a foreign

investor who has limited expertise. For an NRI, no specific approval for

investing or redeeming from mutual fund is required. However, certain mutual

funds such as Franklin Templeton, Fidelity and Quantum for example, will not

accept deposits from NRIs based in the USA or Canada. If you are a USA / Canada

NRI, it is especially important to first check the fund house rules before

investing, so that money is not locked away for a few days before simply being

returned to you rather than being invested.

Real Estate in India

is another favourite with NRIs. The clear benefit here is that while you are

residing in a foreign country, the apartment / house can be given out on rent,

thereby providing additional income. It is also a common myth that as an NRI it

is not possible to get a home loan – an NRI can certainly avail a home loan to

purchase a property in India.

You must also keep

in mind the taxation of your investments.

Taxation for

NRIs

Incidence of tax for

different tax payers is summarized as below:

| Residential Status |

Indian Income* |

Foreign Income** |

| Resident and ordinarily

resident (ROR) |

Taxable |

Taxable |

| Non-Resident Indian (NRI) |

Taxable |

Not Taxable |

*Indian Income means income which

is received in India or accrues

or arises in India.

**Foreign Income means income which

is neither received in India and

does not accrues or arises in India.

In the case of a Non

Resident, only the income earned or received in India is taxed in India.

Accordingly, income earned outside India would not be taxable in India.

Tax on

Dividends

Dividends declared

by equity-oriented funds (i.e. mutual funds with more than 65% of assets in

equities) are tax-free in the hands of NRI investor.

Dividends declared

by debt-oriented mutual funds (i.e. mutual funds with less than 65% of assets in

equities), are tax-free in the hands of the NRI investor. However, a dividend

distribution tax (which varies for individual and corporate investors) is to be

paid by the mutual fund on the dividends declared by them.

Dividends received

from foreign companies are taxable in the hands of shareholder as the foreign

companies are not liable to DDT

Taxation of

capital gains on mutual fund

A unit of a mutual

fund is treated as short-term capital asset if it is held for less than 12

months.

Short Term Capital Gain:

When the units in

Equity Oriented Mutual Fund are sold (redeemed) within one year

of being held by the investor, it becomes short term gains or loss. The Short

term gains are taxed at 15% on gain

When the units in

Debt Oriented Mutual Fund are sold (redeemed) within one year

of being held by the investor, it is taxed under slab rates applicable to

Individual.

Long Term Capital Gain:

When the units in

Equity Oriented Mutual Fund are sold after holding for more

than a year, gains on such units redemption is tax free

When the units in

Debt Oriented Mutual Fund are sold after holding for more than

a year, gains on such units redemption is taxable as Long term Capital Gains.

Long-term capital gains on debt-oriented funds are subject to tax @20% of

capital gains after allowing indexation benefit, or at 10% flat without

indexation benefit, whichever is less.

Indexation benefit

is when the cost of the investment is raised to account for inflation for the

period the investment is held. This is done by using a cost inflation index

number released by the tax authorities every year.

Let's say that you

have invested Rs 1 lakh in a mutual fund on March 30, 2005 and redeemed these

units at Rs 1.5 lakh on April 1, 2010.

As per indexation

benefit, according to the Cost Inflation Index levels announced by the

government every year the cost of acquisition would be deemed to be Rs 148,125

lakh. Your long-term capital gain on this transaction with indexation benefit is

just Rs 1,875. The tax liability thus would be Rs 375.

Without indexation benefit, long term capital gain

will be Rs. 50,000 and tax liability would be Rs. 5,000.

Types of Bank Accounts

An NRI must also

consider which account he should be investing from. But before doing so, it is

important to take into account some points:

- Are the funds in the bank account from

which you will be investing, obtained from Indian sources or are they

repatriated (brought back home) from the country in which you are working?

E.g. Are they your salary funds?

- In which currency do you want to hold the

bank account?

- Do you plan to repatriate the funds in the

account back into the foreign currency, in order to take it back to your

country of work?

Based on the answers

to these questions, you can decide whether you need to invest from your NRE (Non

Resident External) account or your NRO (Non Resident Ordinary) account.

NRE Account: In an

NRE account, your funds in foreign currency are converted into Indian rupees, at

the rate prevailing at the time of transferring the funds from the account. The

principal as well as the interest is freely repatriable or can be transferred to

the foreign country. Funds in the NRE account can be freely repatriated.

NRO Account: If you

want an account to transfer Indian earnings, an NRO account is suitable for you.

Foreign funds can also be deposited into this account. The interest income

earned on in this account is subject to tax in India. The interest is subject to

income tax deduction at source @ 30% plus applicable surcharge plus education

cess. Funds in the NRO account cannot be repatriated abroad.

In

summary, there are many points to note when investing as an NRI, we hope this

article sheds light on some of the common queries NRIs may face when investing.

Courtesy:

http://www.personalfn.com/

|